Financial Aid Literacy

® SUNY Smart Track

SUNY Smart Track is dedicated to helping our students and their families to make the best decisions in college financing. It is important for our students to gain as much knowledge as they can in these areas. As part of the SUNY student's college experience and as part of the SUNY Smart Track initiative, SUNY has developed a system wide financial literacy tool for students. After you create your personal account and log into the program, you will see detailed courses on budgeting, identity theft, and borrowing. Included are tools videos, financial calculators and the ability to save your activity and coursework, quiz scores and access to your budgets.

You will notice we have supplied you with an array of pertinent "Articles" on financial management. Additionally you will find questions from financial experts with topics that include, savings, student loans, credit and budgets. Your financial questions may change as your college career progresses. These articles and tools will aid you in your through college and graduation.

We hope that you will take advantage CashCourse, this real-life guide to making smart money choices in college and beyond.

Scams

The Department of Education Office of Inspector General released a public service announcement warning borrowers of scams regarding the recent Biden-Harris Administration Student debt relief initiative.

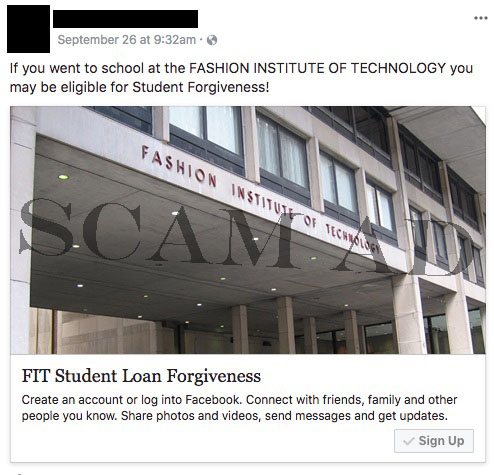

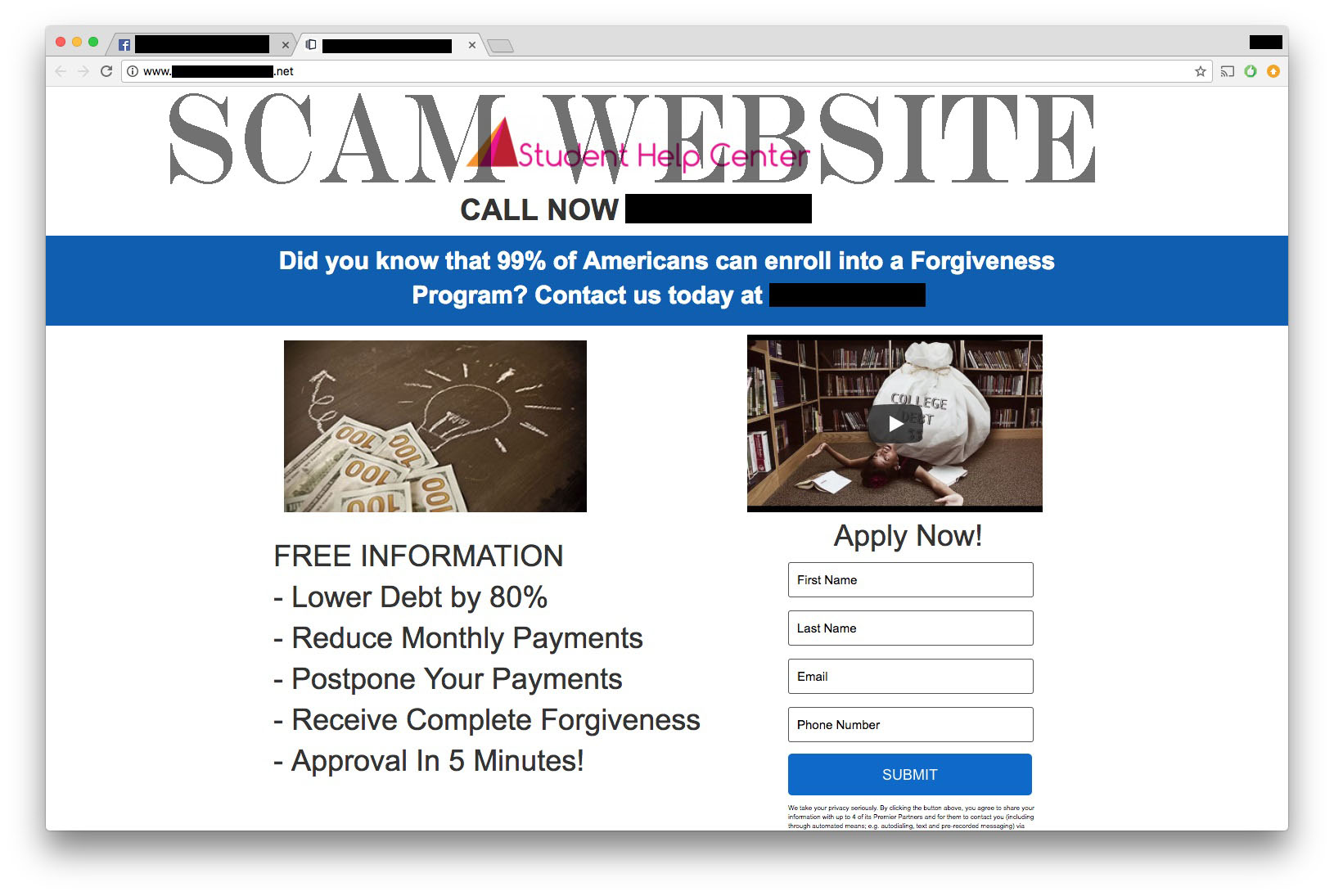

Students and graduates of FIT have reported receiving messages offering loan forgiveness. Some of these loan forgiveness offers contain links to malicious websites. Scams can also come from phone calls and text messages.

- Beware of phone calls, emails, texts and social media messages from anyone claiming that the can help you with student loan forgiveness.

- Beware of anyone offering to move your application through the process or offers to consolidate or refinance your loans for a fee. You can do this for yourself for free.

- Be careful of requests for personal information. Don't share your FSA ID with anyone, even if they say they work with your loans servicing company.

- Be careful of emails with links or attachments embedded in the emails. Hover over the links with your mouse to see if these links are what they say they are.

- Look for misspelling in the emails address, the body of the message, or the links.

Below is a sample of a Facebook ad and a scam website.

How to Avoid Student Loan Forgiveness Scams

You do not have to pay for help with your federal student loans. There is no cost from the U.S. Department of Education and your federal loan servicer can help you.

Contact the Office of the Inspector General OIG Hotline if you suspect your personal information was stolen because of one of these scams. Share a copy of the text, email or phone number of this message you received. Notify your loan servicer as soon as possible to let them know.

A warning from the Federal Trade Commission (FTC) has been issued regarding a current email scam that is being sent to students advertising how to receive an economic stimulus check. These phishing emails have misleading subject lines such as "Memo from The Financial Aid (COVID-19 Relief Fund)" and ask for personal information.

You should not answer emails with any request for financial aid or personal information

if the email is not an FIT email. Do not answer email asking for login information

or follow a link that will download malware. For more information, you can go to NASFAA and the Federal Trade Commission websites.

Email [email protected] if you have questions about an email regarding financial aid.

There are unscrupulous companies that may guarantee scholarships, grants, work-study, and loans or will charge a fee to provide applications services to handle your paperwork. The only application for Federal Student Aid is the Free Application for Federal Student Aid (FAFSA) at fafsa.gov.

For more information about scams, we suggest you read Scholarship and Financial Aid Scams on the Federal Trade Commission website.

There are free scholarship searches online, so don't waste your money on fee-based scholarship matching services. If you have to pay money to get money, it is probably a scam. Do not give money, bank account information, or credit card information to anyone claiming to have a scholarship for you or to anyone guaranteeing you will get you a grant or scholarship.

For more information regarding scholarship scams visit FinAid.org and Common Scholarship Scams.